What’s Going on in the World of Short-Term Rentals? A GBTA 2024 Recap

Maura Carey, VP of Content and ResearchAt the 2024 GBTA Convention in Atlanta this past week, Dwellworks Living engaged with over 1,100 corporate buyers representing 600+ companies with a full agenda of travel industry debriefs and customer needs assessments. The main floor keynote presentations included speakers sharing thoughts on understanding human behavior, innovating for transformation, solving sustainability challenges, reviewing the current state of the industry, and looking to the future. As a presenter at one of 86 content education sessions, Dwellworks Living addressed many of these topics as well in our panel on “What is Going on in the World of Short-Term Rentals?”

Short-Term Rentals (or STRs) in this context are defined as properties rented out on marketplace platforms like Airbnb, VRBO, and others by property owners looking to earn income from either their primary residence or an investment property. This sector exploded during the pandemic, creating millions of new rental options, but not all of them are professionally managed, and as a result, when used for business travel, these rentals have created risk for both travelers and their employers in the form of safety, security, and alignment with local rental rules and regulations.

Recognizing that travel managers and their employees alike are interested in options beyond hotel stays, we explored this topic at an ideal time as STRs have come under increased scrutiny. The panel, hosted by our Director of Sales Dawn Brandenburg, included Nick Estrada, CEO of CHPA (the Corporate Housing Providers Association), Peggy Smith, Chief Innovation Officer at National Corporate Housing, and our President and CEO James Conigliaro. In this blog, we’re recapped the session and key takeaways for travel buyers and policy managers in travel and global mobility.

Aligning on Terminology: Defining Different Types of Rentals

In the context of this conversation, Short Term Rentals are typically used for stays up to 7 days and the properties, typically, are residences owned and managed by individuals or investors. Most commonly used for leisure travel, STRs may also be an option requested by business travelers, though not commonly included in a corporate travel portfolio of accommodations options. In our instant poll, fewer than 5% of respondents said their travelers use this accommodation type.

Mid-Term Rentals (MTRs) are typically for stays of 7+ days, addressing the needs for business travel, group trainings, projects, temporary housing paid by insurance providers, and interim housing for relocating employees prior to moving into their long-term housing. The mid-term rental market is served by furnished apartments, corporate housing, aparthotels, extended stay properties, and other hotel alternatives.

Long-Term Rentals (LTRs) are typically unfurnished rentals secured by a lease between tenant and landlord for 12 months or longer. While Long-Term Rentals were not the focus of our GBTA education session, the scarcity of long-term rentals in many key global gateway cities is an underlying factor for many of the regulatory actions taken by local governments.

Why the Regulatory Scrutiny of STRs?

Regulation of short-term rentals is not new but has become increasingly more visible thanks to headlines like Barcelona’s decision to ‘completely eliminate’ short-term rentals by 2028. The surge in leisure travel in the past few years has been supported by over 5 million hosts on Airbnb and its competitors. While 80% of the properties are in true tourist locations (think, Orlando, Florida) thousands of properties are also in high-density cities that are both tourist destinations and major employment centers with extreme housing shortages. The availability of long-term unfurnished rentals is at a historical low in many of these locations (see our Quarterly Rental Market Update blogs for North America and Europe) and that has caused friction in the marketplace.

Responding to local pressure to increase the stock of long-term rental inventory as well as decrease the ‘noise and nuisance’ factor associated with tourist bookings, municipal and regional governments saw an opportunity and began implementing and enforcing STR restrictions at an accelerated pace. For an example, read our blog to see how Local Law 18 has affected New York City.

What Markets are Seeing Significant Short-Term Rental Regulation?

In our panel discussion, we summarized the impact of STR regulation in four high profile markets.

New York City - Short Term Rentals must be for 30 days or more, the property occupant must be present, and properties must be registered with the city. Enforcement is the responsibility of both the property owner/occupant and the marketplace booking platforms. Fines are imposed for lack of compliance. Since the aforementioned law took effect in September 2023, online short-term rental listings in New York City have decreased by 80%.

Vancouver/British Columbia - STR restrictions are in force across this Western Canadian province, but most directly impact Vancouver, which is a major business hub and business travel and relocation destination. Effective 1 May 2024, short-term rentals for stays of less than 90 days are subject to restrictions similar to those in New York City and for the same reasons. The intent is to create more long-term rental inventory but since the law was just enforced, there is not yet enough data to assess the impact.

European Union - The EU, where many of the headline stories about short-term rentals have been focused, has not adopted region-wide regulations on STRs. Rather, effective later this year pending final review, the EU will require member states to provide data on short-term rentals through ETIAS (the European Travel Information and Authorization System) which is an EU-wide platform for tracking the impact of travel and travel services of all types (immigration, transportation, housing, and more). The intention is to track regulations and travel data for the next two years across travel hubs like Barcelona, Amsterdam, Venice, Florence, and more, and assess the impact of short-term rentals on local economies, leading to policy guidance on STRs in the future.

Singapore - The APAC city-state is an example of longstanding STR restrictions. In Singapore, there is essentially no legal framework for short-term rentals on platforms. The penalties for posting and renting illegal short-term rentals are severe and can include both million-dollar fines as well as jail time. There is ample regulated furnished apartment supply in Singapore through professionally licensed operators.

What’s the Impact of Short-Term Rental Regulation on Business Travel?

Relative to impacting available rentals for business travel, regulation of STRs has had limited impact. As noted, STRs are primarily a leisure travel option and regulation of these solutions is not intended to impede business travel. With that acknowledged, it is also true that many local authorities are not familiar with the travel/accommodations industry terminology, and so there is an ongoing effort, by leaders like Nick Estrada at CHPA and others, to educate legislators and agencies about the difference between professionally managed alternative accommodations options and short-term rentals which are subject to far fewer direct professional operational controls and oversight.

The early indicators are that hotels have benefitted the most from tightened controls on short-term rentals. With fewer online booking options, travelers have had to turn to hotels, who in many markets are reporting record occupancy levels and increased rates. Within 90 days of the implementation of Local Law 18 in New York City for example, hotel rates had increased on average by 11%.

The most important impact of STRs on business travel will not be fewer options for travelers - our sample pool at GBTA confirmed that only 6% of travel buyers approve the use of online platforms for traveler accommodation. Rather, the impact is felt in employee expectations.

What Do Business Travelers and Travel Managers Want?

According to GBTA’s 2024 Business Travel Index Outlook, the highest priority in making travel decisions (for 43% of 4,100 business travelers surveyed) was “maximizing comfort.” We know from experience gained through pandemic that travelers have new accommodations expectations, often influenced by their experiences in short-term rentals for leisure stays. They are asking for larger spaces, more amenities, upgraded furnishings, access to experience, and smarter technology. Employers and travel managers, in turn, are looking for options that are legally compliant, meet duty of care safety and security obligations, and produce cost savings while being responsive to traveler expectations.

The answer to these traveler and travel manager needs can be found in the alternative accommodations sector, which provides fully furnished, comfortable, secure, and often more sustainable (because of a lower carbon footprint) options for the business traveler.

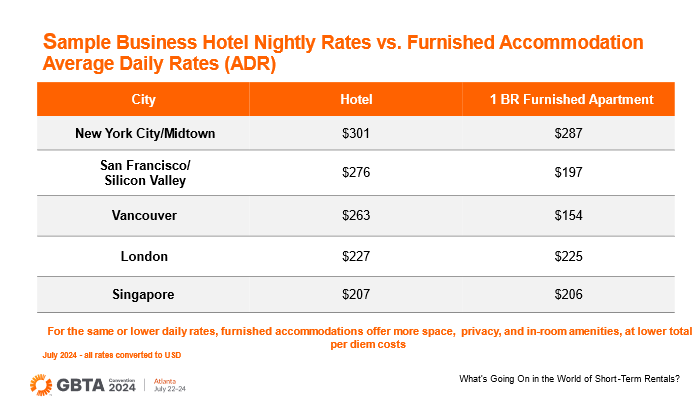

Importantly, for stays of 30+ days, the average daily rate in furnished housing will typically be less than a hotel.

What’s Next for Short and Mid-Term Rentals

As one industry commentator noted at the Skift Short Term Rental Forum in June of this year, the mid-length stay sector, where there is the greatest need for cost and comfort for business travelers, has a ‘discovery and awareness problem.’ In other words, alternative accommodations exist to meet the customized, consumerized preferences of travelers, without the risk associated with leisure-style short-term rentals booked on platforms, with no ongoing process and service oversight.

The alternative accommodations industry is growing rapidly, with record-breaking new members joining CHPA, as cited by CEO Nick Estrada . Recognizing the expectations of the travel marketplace, solutions providers for accommodations needs beyond 7+ days have options in every market, for every traveler’s need and budget. Dwellworks Living, for example, has 80,000+ housing portfolio options available in 125 countries and thousands of business-travel destinations.

Traveler requests for a better extended stay experience do not have to be met with leisure-led short term rentals. More professional, more compliant, and easily sourced and booked options are available in the serviced apartment sector. With travel spend expected to reach 2019 levels by the end of 2024, not exclusively through return-to-travel, but to some extent through inflationary impacts, there is no better time to retire the discovery and awareness problem, and connect travel managers with the cost-efficient, traveler-pleasing experience of professionally managed furnished housing solutions.

Dwellworks Living: Global Solutions for Corporate Accommodations

Dwellworks Living is committed to providing our clients and their employees with the best possible corporate housing and serviced accommodations experience. With a global network of property partners, a tri-regional team of customer experience and supply chain professionals, and a wide range of services for global mobility and travel customers, Dwellworks Living can provide the perfect corporate housing solution for any need or budget.

Dwellworks Living is the global corporate housing solution of Dwellworks, an award-winning, business-to-business provider of global mobility and business travel services. As a global leader in corporate housing and serviced accommodations solutions, Dwellworks Living is uniquely positioned to meet the temporary living needs of businesses and their employees who are relocating or traveling on short-, medium- or extended-stays. With 60,000 high-quality professionally managed properties in over 125 countries worldwide, Dwellworks Living is the preferred housing solutions partner of many Fortune 1000 and leading relocation management companies.

Dwellworks Living's corporate housing and serviced accommodations solutions are designed to help businesses attract and retain top talent, support employee productivity, and ensure a smooth and successful relocation or business travel experience. In addition to our core global accommodations management services, Dwellworks Living, through our worldwide network of local experts, is uniquely capable of offering our clients expanded and related services, such as area orientations, group move assistance, destination services and intercultural training.

Whether you have corporate housing needs for an individual employee or a large team, Dwellworks Living can provide the serviced accommodations solutions you need anywhere in the world to ensure a safe and successful stay. Please contact us to learn more or visit our Properties page to begin your search for global corporate housing accommodations.